Altair Nanotechnologies, Inc. (ALTI) has seen its shares soar over 200% during the last two weeks on heavy volume. However, the lack of news from the company combined with poor fundamentals leads me to believe that this is a temporary pump of the stock and the stock will soon retreat from $8 back to the mid $2 range. I think this company is a compelling short, especially at current levels, however, when a company is pumped up to such extreme levels, it can take some time before the pullback occurs.

Altair Nanotechnologies, Inc. (ALTI) has seen its shares soar over 200% during the last two weeks on heavy volume. However, the lack of news from the company combined with poor fundamentals leads me to believe that this is a temporary pump of the stock and the stock will soon retreat from $8 back to the mid $2 range. I think this company is a compelling short, especially at current levels, however, when a company is pumped up to such extreme levels, it can take some time before the pullback occurs.

CHART AND RECENT HISTORY

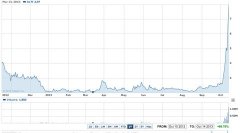

The stock had been trading in the $2 range for about six months, when without any warning, it exploded 200% on heavy volume. When moves like these occur without any news it is usually an indicator of a stock being temporarily pumped [see figure 1 taken from TD Ameritrade's news platform]. Additionally, only 110, 000 shares are short which is less than 3% of the float, which tells us this was not a short squeeze either (the last "Days To Cover" number is also meaningless since volume has reached over 1 million shares a day) [figure 2]. Something to note: from the company's latest 10Q we can see the company has more than 400, 000 outstanding warrants with an average strike price of almost $15 [figure 3]. So if you're asking yourself who might want to pump the stock to astronomical levels, perhaps it is someone wanting to exercise the warrants.

(Click to enlarge)

Figure 3

FUNDAMENTALS

In figure 4, which was captured when ALTI had a million market cap and was trading at roughly $5 a share, we can see how ALTI compares with its competitors. And, due to the run up to $8, the current market cap is $92.6 million, which is higher than ALL of its peers by a significant margin. Meanwhile, the company has produced a loss greater than all of its competitors except two. The company also has the second lowest amount of net sales. According to a recent "TheStreet" report from October 10th 2013 [need TD Ameritrade platform to access), "stockholders' equity ("net worth") has significantly decreased by 29.24% from the same quarter last year." Also, despite increasing revenue Q/Q the company's return on equity has remained constant at -47.5% while the industry average is 15.4%, according to the report. Additionally, cash dropped from $35 million in Q2 2012 to just $14 million in Q3 2013. The company has a price to sales ratio of 13.19 while the industry average is 2.22, and we can't measure the price to earnings ratio because the company has no earnings! These numbers suggest a struggling company, a company that is most definitely not worthy of a 200% price increase.