Flexible, Printed Electronics – At the Tipping Point

By Heidi Hoffman, senior director, FlexTech Alliance

SEMI members are the infrastructure upon which the modern microelectronics (IC) industry is built. Over the past 50 years the IC revolution led to unprecedented growth in information technology and information services. By deploying IC technology in commercial and defense applications, new technologies emerged, employment grew, and wealth creation flourished. Historically, ICs have been fabricated on silicon wafers, while other electronic devices, such as flat panel displays (FPDs), are built on increasingly larger glass substrates. Are stretchable, conformable electronics in the industry’s future? Has this nascent technology reached a tipping point?

As background, flexible electronics are incorporated into textiles, building materials and other surfaces, creating ubiquitous, human-scale environmental intelligence – for example, smart buildings that adjust their own environments for optimal energy consumption or clothing that adapts to the wearer’s needs and which monitors physiology. Printed electronics uses existing graphics publishing industry manufacturing capacity to produce literally square miles of circuitry at high speeds and vastly reduced costs. Electronics can be printed with nearly any method, including screen, offset, gravure, flexo or ink jet printing, with feature sizes in the 10-20 micron range – the same as or better than microprocessors of 20 years ago. Combined together, a new industry emerges: flexible, printed electronics (FPE)

As background, flexible electronics are incorporated into textiles, building materials and other surfaces, creating ubiquitous, human-scale environmental intelligence – for example, smart buildings that adjust their own environments for optimal energy consumption or clothing that adapts to the wearer’s needs and which monitors physiology. Printed electronics uses existing graphics publishing industry manufacturing capacity to produce literally square miles of circuitry at high speeds and vastly reduced costs. Electronics can be printed with nearly any method, including screen, offset, gravure, flexo or ink jet printing, with feature sizes in the 10-20 micron range – the same as or better than microprocessors of 20 years ago. Combined together, a new industry emerges: flexible, printed electronics (FPE)

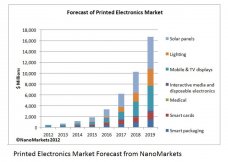

This vibrant new industry, which combines the breadth of the printing industry with the technical sophistication of smart electronics, provides a compelling, yet unproven, market opportunity. Indeed, industry analysts differ greatly in their estimate of the size of the FPE market. IDTechEx gauges a multi-billion dollar printed electronics (PE) market in 2013 (not all printed and predicated on an emerging OLED display market), while Yole sees PE reaching ~$1 Billion in 2020. A reasonable estimate is from NanoMarkets, which forecasts a $1.15B PE market in 2014 growing to $16.7B in 2019, a CAGR of 58 percent (see adjacent chart).

While disagreeing in market size, all analysts acknowledge that emerging FPE applications are in sensors, power, communications, and lighting. In a recent report IDTechEx wrote that “stretchable electronics, logic and memory, and thin film sensors are much smaller segments but with huge growth potential as they emerge from R&D.”